- Calculators

- ::

- Financial Calculators

- ::

- Compound Interest Calculator

Compound interest calculator

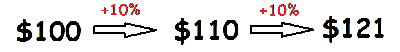

Compound interest is calculated on both the initial payment, and the interest earned in previous periods.

working...

Examples

ex 1:

What is the value of a $4500 deposit at 7% compounded annual interest if it is held in a

bank for 9 years?

ex 2:

What will a $3500 deposit at 10% compounded

monthly be worth after 8 years in the bank?

ex 3:

How much money would you need to put today at 8% annual

compounded monthly

interest to have $1200 in the account after 12 years?

ex 4:

Determine the present value of $1000 at a 12% annual interest rate compounded

quarterly at the end of two years.

ex 5:

What is the estimated yearly interest rate if you give someone

$1700 and get repaid

$1910 in two years?

ex 6:

Assume that a savings account with a principal of $1350 is

compounded monthly.

After 8 months, the total had risen to $1424. What was the interest rate per year?

ex 7:

How long does it take $4300 to grow to $6720 when compounded quarterly at

9%?

Related calculators

Search our database with more than 300 calculators

452 861 664 solved problems

×

ans:

syntax error

C

DEL

ANS

±

(

)

÷

×

7

8

9

–

4

5

6

+

1

2

3

=

0

.